Equity Bank Group has announced plans to terminate the employment of 1,200 staff members following internal investigations into suspected fraudulent activity and cybersecurity lapses within the institution.

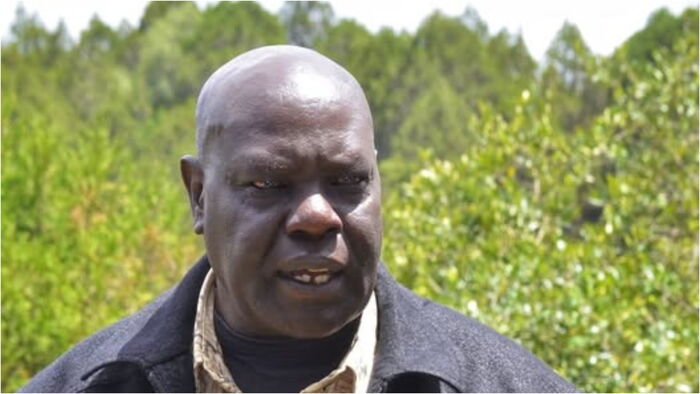

The move was disclosed by Group Managing Director and CEO, Dr. James Mwangi, during the release of the bank’s first-quarter financial results on May 29. The lender’s profit for the period ending March 31, 2025, fell sharply, prompting the bank to intensify its internal review process.

Mwangi confirmed that the affected employees had been issued termination notices, each given a two-day window to defend themselves against allegations of misconduct. The internal probe was triggered by unusual activity detected in staff bank accounts and mobile money wallets, raising suspicions of unethical financial practices.

“This marks the beginning of a rigorous cleansing process at Equity Bank. I will not protect anyone involved in fraud. The integrity of our institution and the safety of our customers’ funds come first,” Mwangi stated firmly.

This development comes shortly after a separate batch of 287 employees—including senior managers—were dismissed earlier in May following an investigation into over 700 staff members. The recent crackdown is part of a broader effort by the bank to restore public trust and tighten security in the wake of persistent fraud cases.

As of 2024, Equity Bank had 14,000 employees, up from 13,102 in 2023. The potential loss of 1,200 workers marks one of the largest workforce cuts in the bank’s history.

In response to increasing fraud incidents, Equity had already taken steps in 2024 by hiring a team of cybersecurity and fraud management experts. Despite these efforts, insider threats remain a significant concern, leading to the current wave of dismissals.

While the bank has yet to reveal the total financial impact of the fraud cases, Mwangi reiterated that Equity will continue to implement strict internal audits and behavioural monitoring to safeguard customer deposits.

The banking industry in Kenya has recently come under pressure from both digital fraud and public scrutiny, prompting institutions like Equity to adopt more aggressive counter-fraud strategies.